Tariff Shakes returns to global markets: Ibex Futures 3% and Asian facing strong cuts | Financial markets

Sales Wave returns to global markets with new jealousy. United States President Donald Trump’s massive tariff plan6 Spanish came into force for the hour, Including the 104% rate for China announcing the president yesterday. Trump has moved these orders in global trade, which has been established for decades, intensified the fears of depression, and shakes historic markets in the economic markets. After a negotiation day, the European and Asian bags took a break, the red numbers return. IBEX Futures 3.16% and Euro Stoxx 50 3.5% go back. In Asia, the major Asian indicators are lost between 1% and 3%. American futures fell 1.5%, and the fifth consecutive day on Wall Street also pushed for losses. The dollar weakens compared to the euro and drops up to $ 60 per oil barrel. The VIX volatility indicator, known as the Fear Index, is more than 50 points, which adapts to alarm levels in investors.

Trump has sent contradictory signs on whether the tariffs will be long -term – he defines “permanent” – he has also felt negotiations with Japan and other countries – requested conversations as it leaked over 50 governments. “Many countries are coming. They want to enter into deals,” the president said at a function at the White House on Tuesday afternoon. Investors put their hopes in these allegations and Europe and Asian bags ended the calm session on Tuesday. However, the announcement of a new punishment for China has given a good voice and Wall Street has been rejected. Said Trump Applies an additional 50% of tariffs to Asian giant from Wednesday And the three -fold decree has been approved for platforms such as Tem and Sheen from China. American indicators who have recorded an increase of 3%have lost 1%.

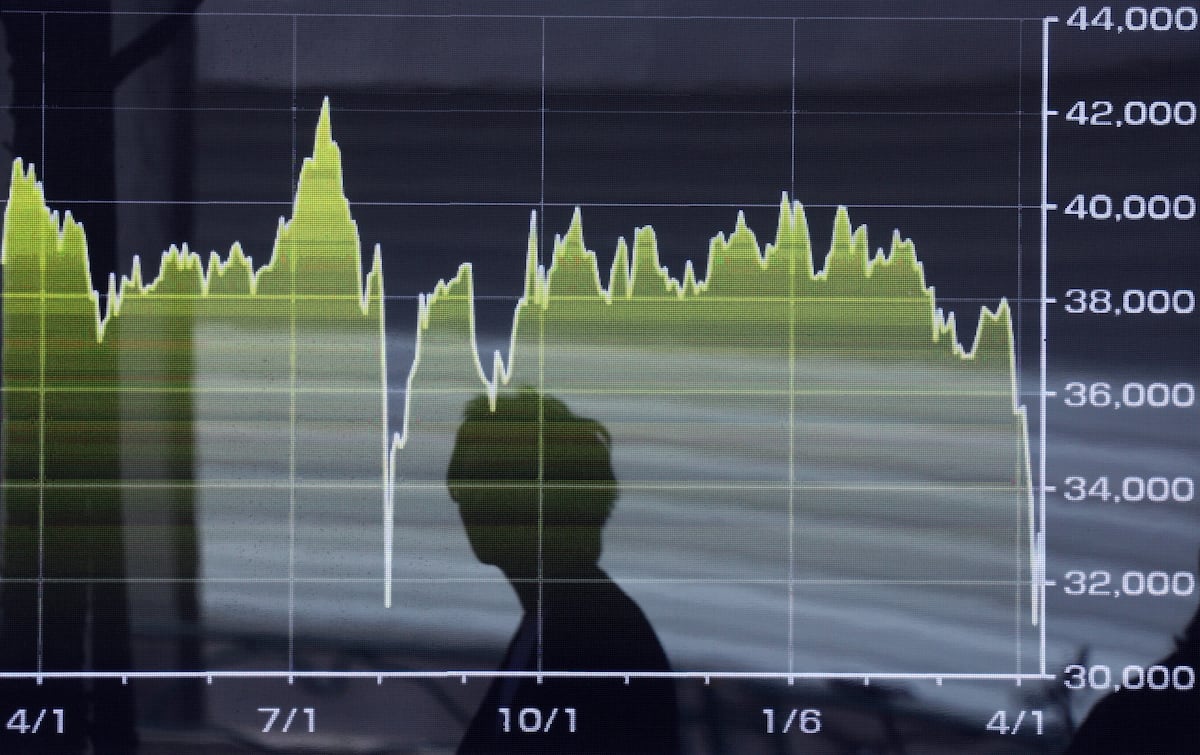

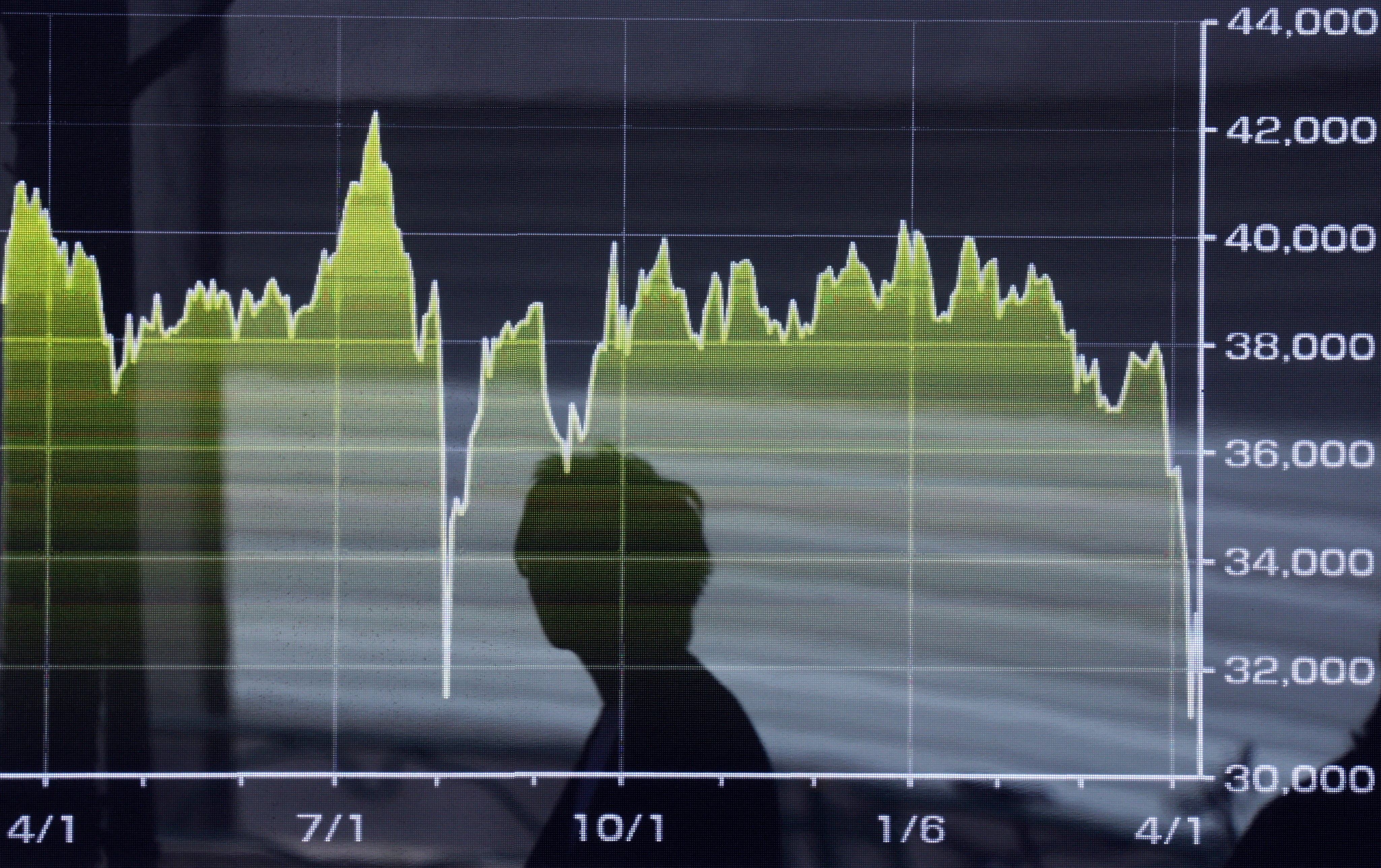

Japan Nicky fell more than 4% today and over 12% of the week has been demolished since the announcement of the tariff plan, despite Tuesday interval. Hong Kong Hong Seng is 2% and Korean Kospi, 1.6% left. The Shanghai Composed Index will increase by 0.2%by defeating descending, after adhering to stabilizing the prices of 10 operations in the main Chinese stock market houses, Shanghai bag said. Participants include Cetic Securities, Orient Securities and Industrial Securities.

According to Reuters Data, the S&P 500 has lost nearly 6 billion capitalization since Trump announced taxes in four days of index created in the 1950s. The S&P500 has now reached the bear market, defined by a maximum of 20%: the indicator is now less than 5,000 points and 19% lower than 6,144 points marked mid -February.

The storm also reaches currencies. The dollar goes back 1% compared to the European currency and the price of each euro is 10 1,105. Yen and Swiss Franco, who have been in turmoil, continue to strengthen themselves against the dollar.

In the raw material markets, the tariff barrage makes the oil in the oil, and the reference brent barrel in Europe falls 4% and is close to $ 60. The United States’s future West has lost more than 4% to Texas Intermediate Barrel to $ 56.92.

Gold, at the same time, takes the growth: OUNNS adds 1.4% and reaches $ 3,033, with a maximum detected at a maximum of $ 3,100 last week.

Due to the extraordinary uncertainty caused by the tariff barrage, analysts do not dare to assess the influence of new levies on the economies. “It is impossible to reasonably assess the impact of the current trade war between the United States and China,” the Nomura report said.

Scholarship – Foreign exchange – Debt – Interest rates – Raw materials