Powell | Financial markets

Markets do not even rest on holidays, especially with Donald Trump in the Oval Office. This Monday, most of the closed world bags (including European), US indicators will speed up to 3% Conflict between Donald Trump and President of the Federal Reserve Jerome Powell. The pressure from the White House in the Central Bank began last week, and Trump has increased the removal of Powell. In a new chapter, the United States president Pavel described Powell as a “loser” and mentioned “prevention cuts” in interest rates. “There may be a decline of the economy, even if the Lord is too late, the great loser is not to cut the rates,” he said.

The reaction is immediately in the main Wall Street indicators. The futures market has already deteriorated with 1%drops, session sophisticated (and institutional tension) has accelerated. In the afternoon, Nasdaq loses more than 3%, S&P 500 2.8%and Dough Jones lose 2.7%. This is a great fall from April 10. Responding to Dollar Falls, playing at least three years before the euro (0.88 euros), Chronic treasure bonds also undergo stress. The profitability of the 10 -year paper was triggered by 4.38%, compared to 4% in April 2, the new tariff date. When yields rise, the bonus value has fallen as investors seek more profitability. The continuous conflict caused by the United States has caused the sale of US assets. Traditional active shelter, gold, in its first history, exceeds 4 3,400, so far this year is 25% re -VAL. The Swiss Franco and the Japanese Yen were also strengthened against the dollar.

This new fire caused by Trump restores concern among investors for the US market, in this case for the independence of the Fed, one of the cornerstones of financial stability. The credibility of the Federal Reserve depends on historic independence to act as the most powerful central bank in the world without political influence. “If the monetary policy is a relatively high weapon, it is used to control inflation in the middle period. It depends on the confidence in the central bank,” said UBS Global Wealth Management Chief Economist Reuters Paul Donovan. “It has been a long time to build that trust. It can happen overnight,” he concluded.

Although the possibility of dismissing Trump Powell is weighted in the markets, it is a very complex maneuver. According to legal experts who contacted Bloomberg, a president could not easily dismiss the head of the Federal Reserve. Article 10 of the Federal Reserve Law, Members of the Board of Governors, as part of the President’s President, understand that the President may be dismissed for the cause of the President “and that the analysts are misusing” cause “. “The independence of the Central Bank is very valuable; it is not a big one and it is difficult to recover if it is lost,” said Bloomberg FHN Financial “Threats against Pavel do not contribute to the confidence of foreign investors in US assets, but I still believe that tariff updates are a major factor,” he said.

The battle of the tariff

Trade tension is added to this organizational uncertainty. The negotiations between the US and Japan are still stable, which will at least strengthen the suggestion of a long process until July. “Failure to move towards an agreement indicates a long negotiation period,” said Macquarie’s Theory Vijayman. In this environment, investors get shelter in safe assets. Gold was first over 4 and 3,400, so far this year is 25% re -val. He is Franco Swiss and the Japanese Yen were also strengthened against the dollar. Market analyst Javier Molina in Etero, “is not preparing to bounce bags, they are fighting without breaking.” After the Holy Week stops, the markets are “leaving the disturbing feeling where they do not collapse, but they do not bounce. Without a clear direction, in the atmosphere where there is a high volatility, less liquid and growing declining investment. It is a scene that ends in a breakup, but everything is to do.”

In addition, investors are caring for the start of the US results season. This week, Focus alphabet accounts (Google owner), the manufacturer of Intel Chips and Tesla Electric Vehicle Group. The group of Elon Musk fell more than 7% after the Barclays Investment Bank was cut off against the “confusion” visibility of the first quarter results. Apple also drops more than 3%, but Netflix will increase its accounts last week by 2%.

“The rise in geographical political tensions is already nervous, and now Trump’s intervention with the Federal Reserve can increase another uncertainty layer,” said Saxo Bank’s strategic head saru Chanana. As a result of them, the threat in the Fed from the crucial analysis company is “related to Trump’s trade war, because Powell is forced to stay away from the impact of inflation in the coming months, and is inspired by tariffs, and all of which have market volatility and increased growth loss”.

Festive in European stock markets

The Spanish and European markets will resume their normal activities tomorrow, April 22 on Tuesday. Ibex 35 It ended on Thursday last week, with a decline of 0.19% up to 12,918 points. The Spanish selective annual growth is 11.41%. The Spanish stock markets and debt markets have six holidays this year, similar to in 2024. The Spanish Stock Exchange has already been closed on January 1. Similarly, it will be a holiday on May 1 (Labor Day), December 25 (Christmas) and December 26.

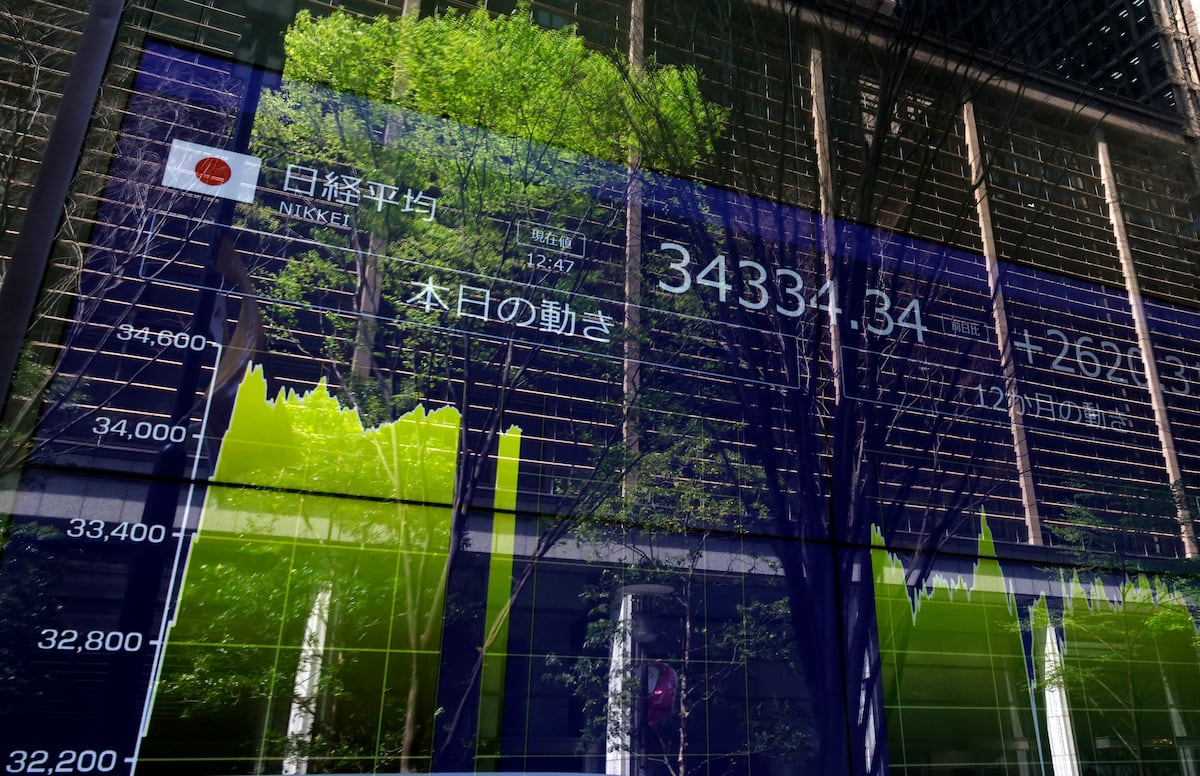

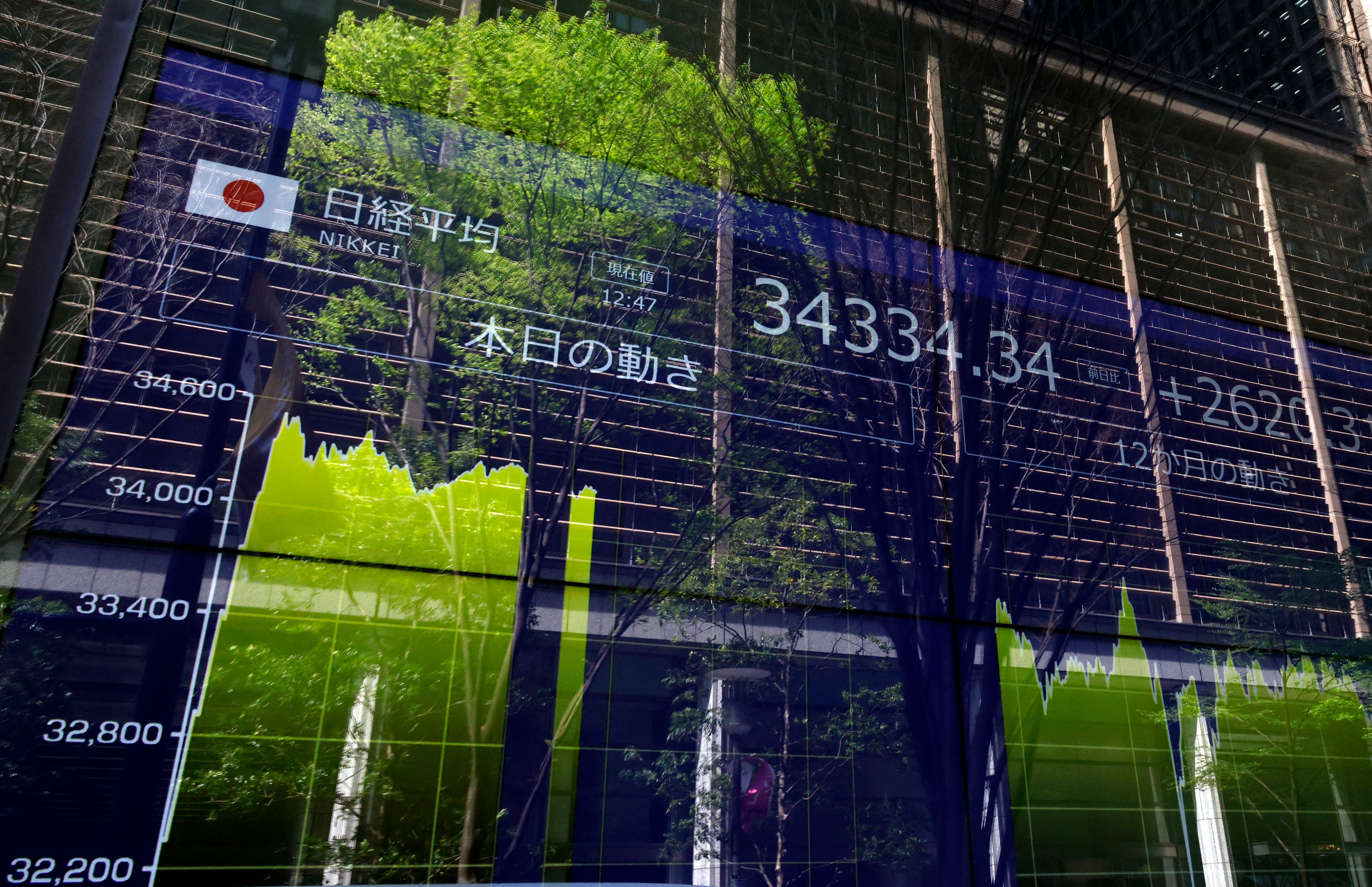

In Asia, the bags are closed with different results during the session, with a few holidays for holidays. Australia, New Zealand and Hong Kong stock markets were closed. Chinese indicators have increased slightly, the nicky of the Tokyo bag fell 1.30%, mostly due to the strength of the yen against the dollar. The fort is similar to the Japanese Finance Minister Katsu Kato’s visit, which is expected to be treated for the USA to the USA to the USA to meet with Treasury Secretary Scott Basent.

In a new episode of trade tensions, China has only launched warning to the United StatesBut any country that discuss commercial rights with Washington can harm their interests. According to various US media, Trump plans to use the current tariff conversations to press Chinese business partners to limit its relations with Asia. Beijing has issued a statement, in which the situation occurs, “it will” take a view of vision and interactions. “

In Spain, the banktar statistics are known on Thursday, giving the initial gun to presentations in the first quarter. In the accounts of companies till March they do not collect the effectiveness of the uncertainty of tariffs (most of the beginning of April), they may give an idea of the business situation before the commercial storm.

In gross financial data, Japan’s CPI has increased on Monday as exposed in March, but the underlying inflation has accelerated due to the constant rise in food prices, which will complicate the latest food prices of the Bank of Japan (BoJ) in the midst of the US Underley US Underley Tensions, which have increased to 3.2%.

As a result, the popular bank of China continued its priority loan rate on Monday, in accordance with market expectations, which represents Beijing’s priority to increase economic growth by economic growth instead of additional monetary flexibility. The PBOC leaves its LPR at 3.1%a year, while the five -year LPR rate used to establish mortgage rates is 3.6%. Two rates are in historical minimum, following a series of cuts in the last three years.

Scholarship – Foreign exchange – Debt – Interest rates – Raw materials