3 factors indicate ‘well -founded high’ trend for bitcoin

We have a very unfavorable gross environment filled with uncertainty and still the risk market is growing.

However, we reveal a significant detachment between data that shows slowdown in the US domestic market, and the negative correlation of market security assets and risk assets, that is, investors buy risk and security simultaneously except the dollar.

- How long do you stop investing in crypto? Explore new ways to open your MYNT account and invest without fear. Click here to unlock your crypto world

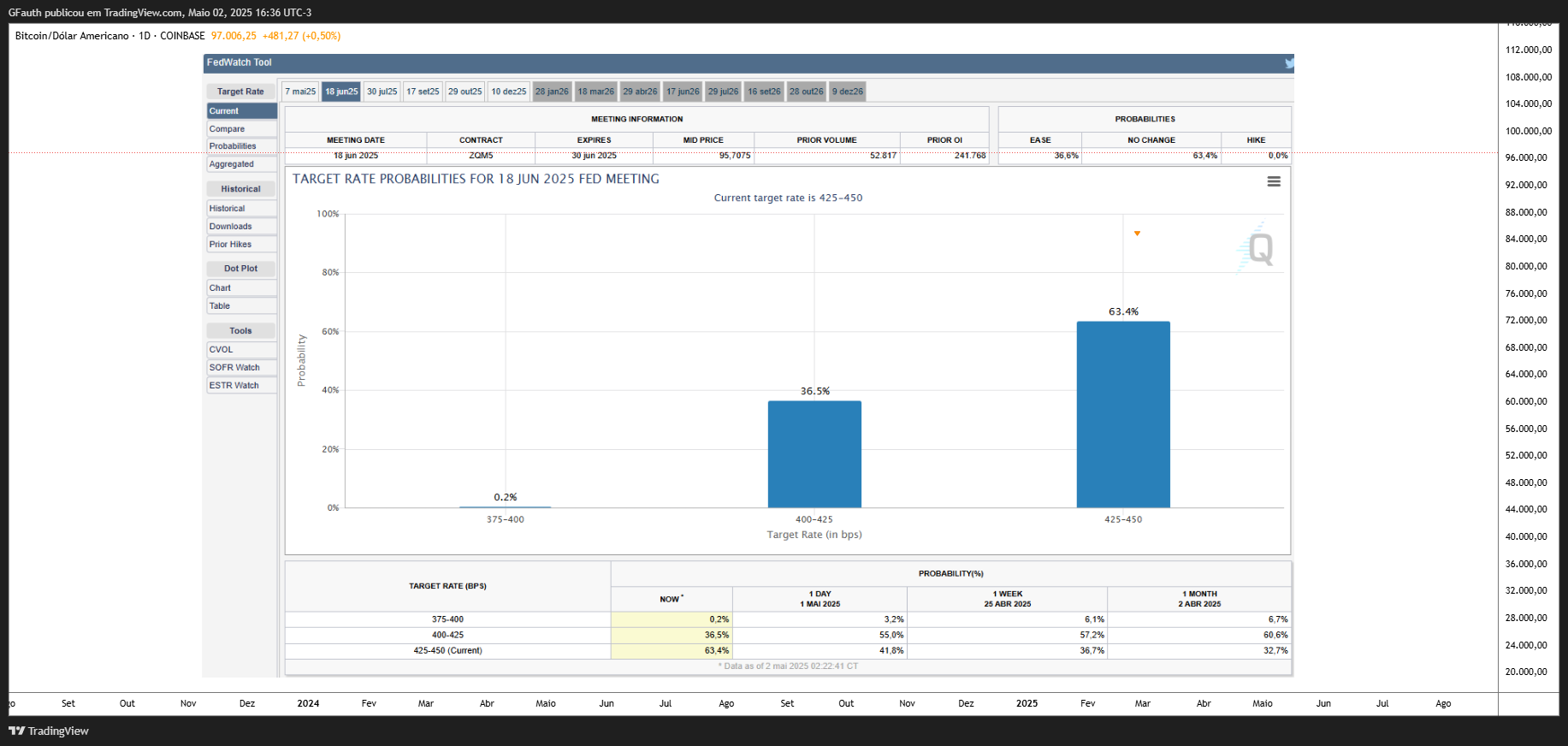

Oh Bitcoin It has been shown to be a traction property with the exit of traditional security assets. At the moment investors have clearly reduced the bet on interest cuts, now we have only one cut in the second part, the current photo is as follows:

3 reasons make me believe in the height that is well found

The main technical engine of this rally is to enter the institutional capital through the ETFs approved at the beginning of the year. This is not a retail or timeline hype, but strategic allocation.

Funds such as Blackrack and Reliability absorbs the circulatory offer of bitcoin at a steady rhythm, which creates continuous purchase pressure, which is equal to reducing new daily emergence Bitcoins After half.

Secondly, the “higher interest rates” from the global market reserve rejects the article. A set of indicators, including core inflation and activity, represents the slowdown. The prices of interested curves show that the market is betting on two thousand twenty five cuts. This reconstruction of the monetary cycle creates a window for liquidity -sensitive assets such as bitcoin.

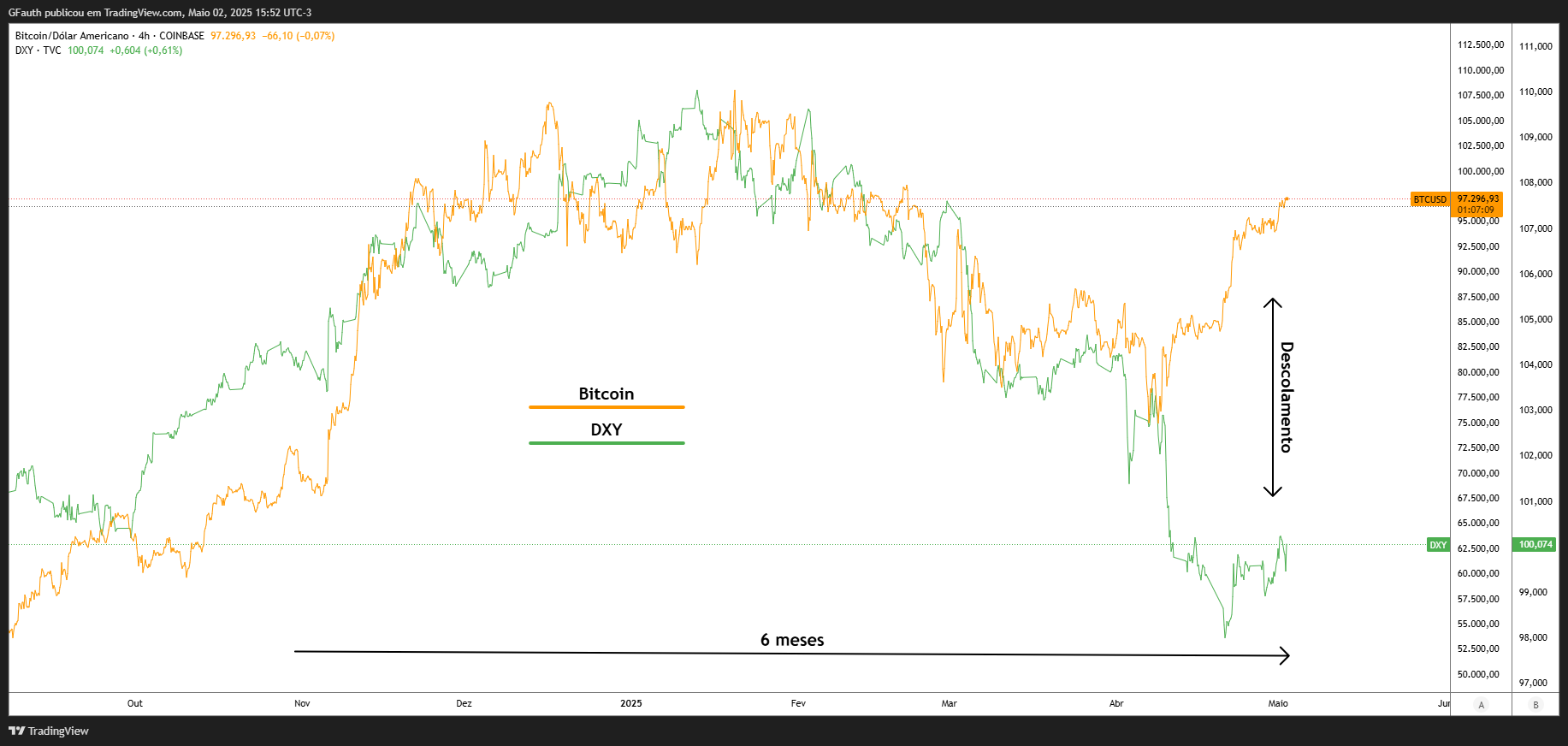

Drops DXY index It also indicates that the monetary loose market in the United States with Perole Forte has been tied up. The weakest dollar usually indicates that investors are migrating to assets with high returns or actual protection.

Third, bitcoin begins to occupy new space in the organizational portfolio matrix: an alternative reserve property. In the wake of the economic imbalance in the United States, there is a search for trust in reliable currencies and increased geopolitical tensions, searching for defense outside the traditional system.

Gold is relevant, but Bitcoin provides complementary qualities: shortage of program, digital portability and state independence. There is a growing thesis that Bitcoin offers a hard money exhibition against the dollar thinner.

My thesis was concluded that there was a rehabilitation flow. The money in fixed income, hoping for a “permanent interest”, has begun to return to tech, growth and crypto, as a means of capturing the start of liquidity rebound even before it is completed.

It only reinforces the market that does not buy “longer long”. It is also looking forward to the reversal with short -term strong data. And bitcoin is more related to tech and liquidity compared to inflation, surf it together.

*Gabriel Fouth She has been a future market operator for 7 years and has been helping market analysis and evaluation in the trading community. Trading View is a tool for graphics for market implementation and analysis, as well as the largest social network for investors and traders.

Follow the future of money on social networks: Instagram | X | YouTube | Telegram | Tictoc