“Eid Gift” for citizens … Saudi decisions control the real estate market in Riyadh

In the real estate market in Saudi Arabia, it is a strategy of economic diversity, which affects the prices, which will affect the prices, the command of Crown Prince Mohammed bin Salman, to take the institutional actions package in Riad in Riad to take the balance of real estate in the capital. Social, social, in any case, in any occasion, socially, socially, achieved, at the same time, how much interest the leadership is interested in providing serious and effective solutions to the challenges facing this important sector.

Third: To ensure the improvement of the Real Estate supply, the white territory system is taking the necessary regulatory measures to issue the proposed amendments to the proposed amendments in an emergency manner within a period of not exceeding 60 days.#Spa

– Spa Royal News (@spagov) March 29, 2025

One of the leading challenges facing the real estate market, the experts in the field have told Ashark al -Avasat.

Real estate prices record increased by 3.6 percent in the fourth quarter of 2024, and it is considered the highest weight in the residential sector (72.7 %), according to the highest speed of quarter growth in six seasons.

Factors affecting prices are related to major development projects that contribute to housing units, especially in major cities, and investments and enhancing transport and services networks in cities that increase real estate value.

After a stage of urban planning for the region, aimed at strengthening the Real Estate supply and controlling market fluctuations, the Riyadh City and the Council of Economic Affairs and Development Council of Economic Affairs and Development came after the Royal Prince orders.

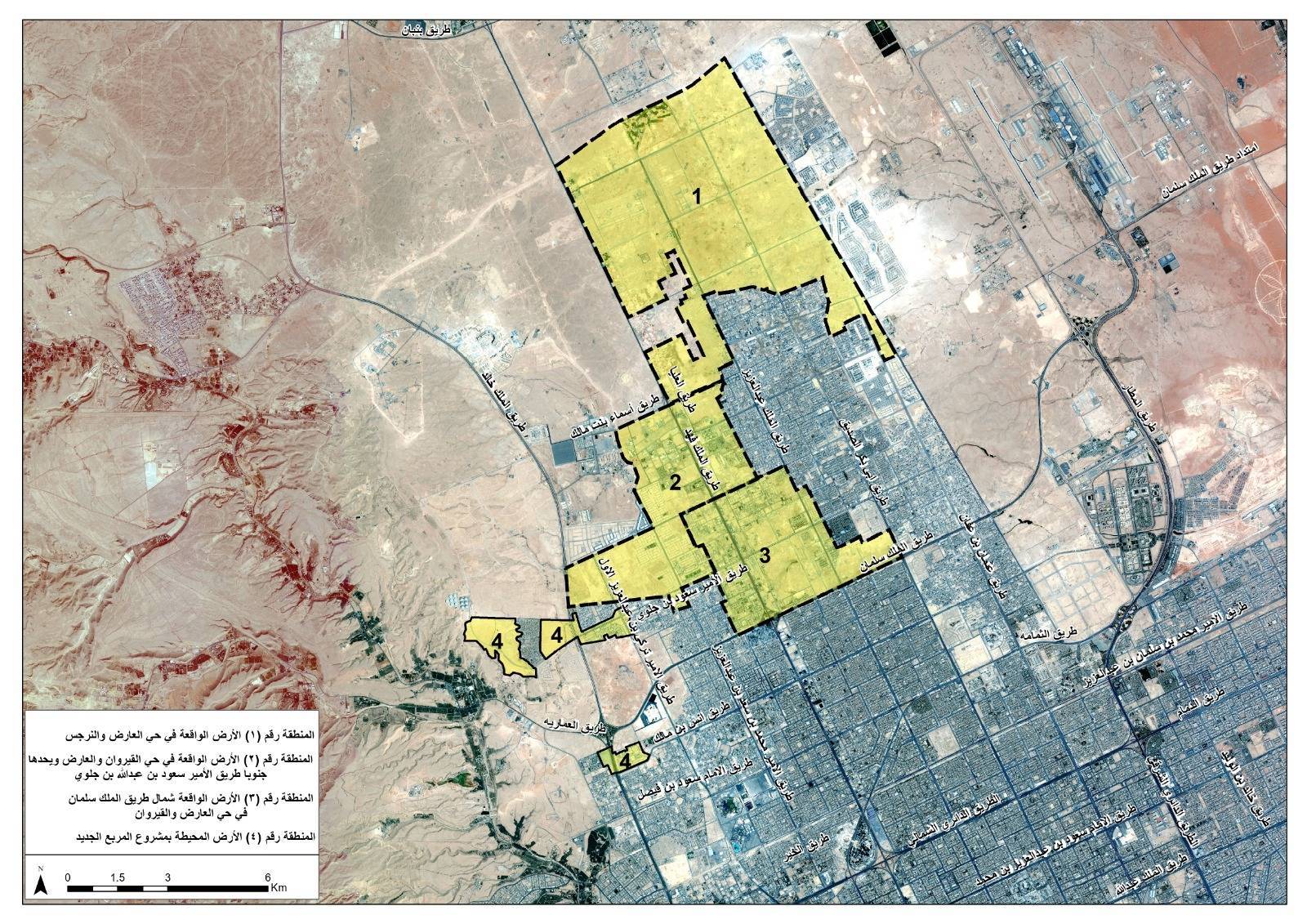

These decisions include suspending sales, purchase and development activities in many sectors of the capital, working to provide a total of 81.48 sq km, and to provide 10 – 40 thousand plots land in the next five years, to give prices to marriage or 25 years per square meter. This is through an electronic platform launching the Royal Commission for Riyadh.

These orders also include controls of land sales, rent or mortgage for the period of 10 years, except for the mortgage to help the construction, and if the project is not implemented during this period, the land will be recovered with its original value.

According to the municipal minister, Rural and Housing Minister Masid Al -Haigail, new policies contribute to achieving a balance between supply and demand, while at the same time struggles to revise the white land program to promote the development of real estate. He believes that the rental system is subject to a comprehensive review to ensure the control of contract relations between the parties, which will be demonstrated in 90 days.

CEO, Eng’s General Authority of Real Estate. To deal with the challenges of the real estate sector, to achieve price stability, and to improve the position of Riyadh life, work and real estate as one of the best global capitals for the development of the world and to support all 2030 people, to focus and provide all the preferred goals for the development of real estate. Abdullah Al -Hamad explained that the commitment of leadership reflects the commitment, “is one of the main engines of the national economy.

High request on property

At this point, the GLL company, which specializes in serving the real estate sector, has issued a report, despite the slowdown in the Middle East and Africa in the year 2024, the sector is strong in Saudi Arabia, as it is $ 29.5 billion in total construction projects. The hospitality, multiple uses and entertainment sectors have seen great activity, but the residential sector has achieved strong performance, but granted $ 7.9 billion worth of contracts, according to the report.

The year 2024 was unusual for the offices in Riyadh, where the increase in demand increases and supply of supply, which had not exceeding 0.2 % of the category buildings (A), the average rent in the fourth quarter reached $ 609 per square meter. The 326.6 thousand square meters of rental spaces were added to the market, with 888.6 thousand square meters in effect, indicating continuous growth in 2025.

The city of Jeddah has emerged as an attractive choice, confirmed to modern high -quality offices in the northwest direction of the northwest, the Dummam market is stable and mainly supports by government agencies.

Strategic projects supporting the “Vision 2030” continue to attract huge investments.

GLL president Saudi al -Sulamani in Saudi Arabia said, “Vision 2030” led by “Vision 2030”, a great incentive for the development of the real estate sector, and attracts local and international capital, and “high -quality assets, and in particular in the main assets, and in the long Creates ”.

With the readiness of the state to maintain the main events, the report suggests that it could face the capacity and higher costs between 2025 and 2028. However, the country is working to deal with these obstacles to increase rehabilitation efforts, continuous investment in infrastructure, and enforcing institutional reforms, and to deal with these obstacles between developing malignant and centralized cooperation.

The head of the GLL’s “GLL” in Saudi Arabia, the head of the Department of Projects and Development Services, said that the strategic projects that support “Vision 2030” will continue to attract huge investments, which will create new opportunities to expand the market. “Huge cash flows for major events such as the World Cup and Expo, which improves the development of infrastructure and keeps the real estate sector in 2025 and more strong growth.”

Appropriate atmosphere

CEO of Real Estate, Khalid al -Mobaiideh, told Ashark al -Avsat that there is a need to provide an adequate supply to meet the growing demand, and that the failure to achieve it will lead to inflation. He explained that expanding development to small cities close to urban centers is an effective solution, as it provides development opportunities at various prices and reduces stress on major cities, while providing home choices that can meet the needs of different categories.

The most prominent challenges facing the real estate market are high real estate prices, labor costs and construction equipment, which affects the profitability of investors. Explaining that there is a solution to investment opportunities in the suburbs and secondary cities, where prices are still affected by inflation, which creates an atmosphere for growth and prize return.

The strong demand is inspiring the growth in the residential sector in Riyadh, where Villas is a very demanding option, which represents 53.3 percent of total transactions. 28943 new units will be distributed in 2025 and the delay of the new supply may lead to higher prices and rent, GLL said.

In Jeddah, apartments dominated last year’s transactions, which accounted for 82.8 percent of 82.8 percent of units in 2025, but limited supply would accelerate prices and rental growth.

Retail and hospitality

The hospitality sector in Riyadh is looking at the well -being of commercial tourism and global activities, increasing daily prices by 13.3 per cent in 2024, with the expectations of adding 2312 hotel rooms in 2025, with the rise of tourism tourism in Tourism tourism.

As the retail sector is heading towards “Experimental Retail” in the capital with increasing demand for recreational activities, occupancy rates in traditional shopping centers are declining due to their closed designs. While the huge centers continued their durability with 1.8 per cent in the fourth quarter of 2024, social centers recorded a 5.5 per cent strong growth, while regional centers fell 9.3 per cent. Jeddah reflects the same trend, which requires a more diverse and experimental shopping environment development.

In both Riyadh and Zedda, rent rises in the industrial and logistical sectors represent strong market activities and storage capabilities and high demand for sophisticated logistical services, according to the rise of the economy and the rise of e -commerce, according to the report.

The fifth generation technologies and artificial intelligence are rapidly growing in the field of Middle East and Africa. Saudi Arabia, especially Riyadh, Dammam and Jedda, has a strong impression in the sector, as it is third in the number of joint data centers in operation and in the end of 2024, it is in good place for 12.6 percent of the total operational information technology capacity in the region.