An interesting phenomenon of negative electricity prices: why they occur and how they affect the user | Companies

From wind turbines in the mountains of Norway to the solar panels in Australian ceilings, filling electric networks as never before. Since the production of these new energy sources is changing winds and the sun, the networks are supplied more power than they can absorb, resulting in an interesting phenomenon Negative energy prices.

This year’s record high hours are likely to be recorded, in which the electricity price is lower than zero. If that cheap energy is good for homes and industries, it is a serious concern for investors in renewable energy assets, as prices threaten the stability of volatility gains.

What is the cause of negative electricity prices?

Like oil and natural gas, electricity is sold in wholesale markets. The difference is that these basic products can be stored until the tanks and large ships are needed, but the size of the batteries that connect to the network to store electricity is not yet equal to The growth of reproductive forces.

Since electricity occurs and instantly consumes, the power produced exceeds the demand and is unable to store for further use, prices may be lower than zero. When this happens, producers must pay customers (selling companies) to take care of the fuel surplus.

Why are negative prices of electricity high?

Attempts to reduce carbon emissions are promoting the quota of renewable forces on networks around the world, which causes power supply volatility.

Power generation from wind turbines increases or decreases dramatically during hours. And the expansion of solar energy becomes an increasing problem when the generation reaches maximum position in the daytime, especially in the afternoon and summer months. Germany, the largest solar market in Europe, exceeds 100 Gigawatts of solar capacity in 2025, and Bloombergnef data is more than twice as much as five years ago. It is estimated that the total solar production in the country will reach nearly 20% of the annual power generation. In Spain, the PhotoVoltaic Solar has a 17% stake in the power produced last year, according to the Electric Red Report.

Due to the coincidence of low demand for electricity on the weekends and holidays, negative energy prices are high and depending on the climate, the persistent flow of reproductive energy.

Do you not turn off additional renewable forces or other energy resources to compensate?

It’s not so easy. Activating and deactivating nuclear, coal and gas plants is slow and expensive. New generation of gas plants that can increase and reduce its production in a matter of minutes. However, the process of coal and nuclear power can take hours for this process, which is “usually working independently from the market price, which increases the impact of other factors that increase negative prices,” said Janik Carl, a researcher Janik Carl.

In addition, there is no fine to continue generating electricity when there is less demand, and state subsidies designed to promote pure energy indicate that renewable generators often have an encouragement to continue to pour electricity on the network After prices turned negative.

Germany tries to address this distortion by qualifying a group of solar producers to their “food rate” when market prices become negative. This is a government subsidy, which guarantees a minimum price to some renewable energy developers for every kilowatt-hour power, even if it does not require that energy.

Some network operators pay renewable assets to disconnect and thereby avoid the system overload, but this is an expensive option. Known as the “limit”, the practice costs 1,000 million pounds (1,174 million euros) in the United Kingdom in 2024 and will exceed 1.8 billion pounds in 2025, the National Energy System operator said.

What countries are most likely to affect negative electricity prices?

In 2008, in Germany, lower electricity prices were recorded than zero, the country increased its air and solar capacity.

In recent years from Europe to Australia and the United States, they have become the most common worldwide.

Finland defeated all other European markets at 725 hours in 2024, compared to only five in 2021, according to Aurora data.

The limited capacity of high voltage cables to export electricity called interconnectors has prevented Finland from selling more than additional production to other countries.

In Australia, the rapid abandoning of coal and the heavy adoption of domestic solar energy has become a test case for fuel transition. The main network of the country has trouble maintaining supply peaks during the bright hours of the day. Prices Spot In the last quarter of 2024, 23% of the time had fallen less than zero during the time of time. Some public service companies, such as OVO Energy, provide free energy to homes during lunch.

Due to the increase in air and solar production and increasing obstacles in the network, the negative prices of energy are high and severe. Prices from Texas and California to PJM Network to the east of the country everywhere are observed under zero, which has 13 states and Colombia district.

In Texas, there are also more demanding hours, from 6.00 pm to 10 pm in the week. According to the network data collected by MCG Energy Solutions that the daily average price in West Texas has been negative for two consecutive days in the West Texas and that Megawashio-Hora has reached 37 7.37.

What’s wrong with lower electricity than zero?

The risk is that renewable forces become victims of their own success. The concessions that encourage the implementation of air and places should be gradually removed in many markets and projects should prove that they can develop without government support. However, negative prices reduce the average wholesale price offered to generators, which reduces green energy gains.

If renewable energy projects are less economically attractive to build, it reduces the transition to the power system of zero net emissions.

In Spain, solar energy is very widespread, which can cause prices for a long time. In an attempt to protect their negative and volatile price projects, renewable energy promoters are signing long -term contracts to sell their power to corporate customers. These deals are usually expanded for more than a decade. However, it runs the risk of exacerbating the problem by creating less incentives for renewable energy producers to reduce generation during the surplus period.

Does anyone benefit from negative energy prices?

Price is creating opportunities for new companies in a field that has long dominated for traditional electricity. Battery owners can take advantage of the power prices that buy electricity to load when prices are low or negative, and download the network when prices rise.

There are also special new technology companies in short -term volume discussions.

Most of this use algorithms to process thousands of transactions per day and take advantage of marginal price differences between markets.

Do negative energy prices refer to low electricity bills?

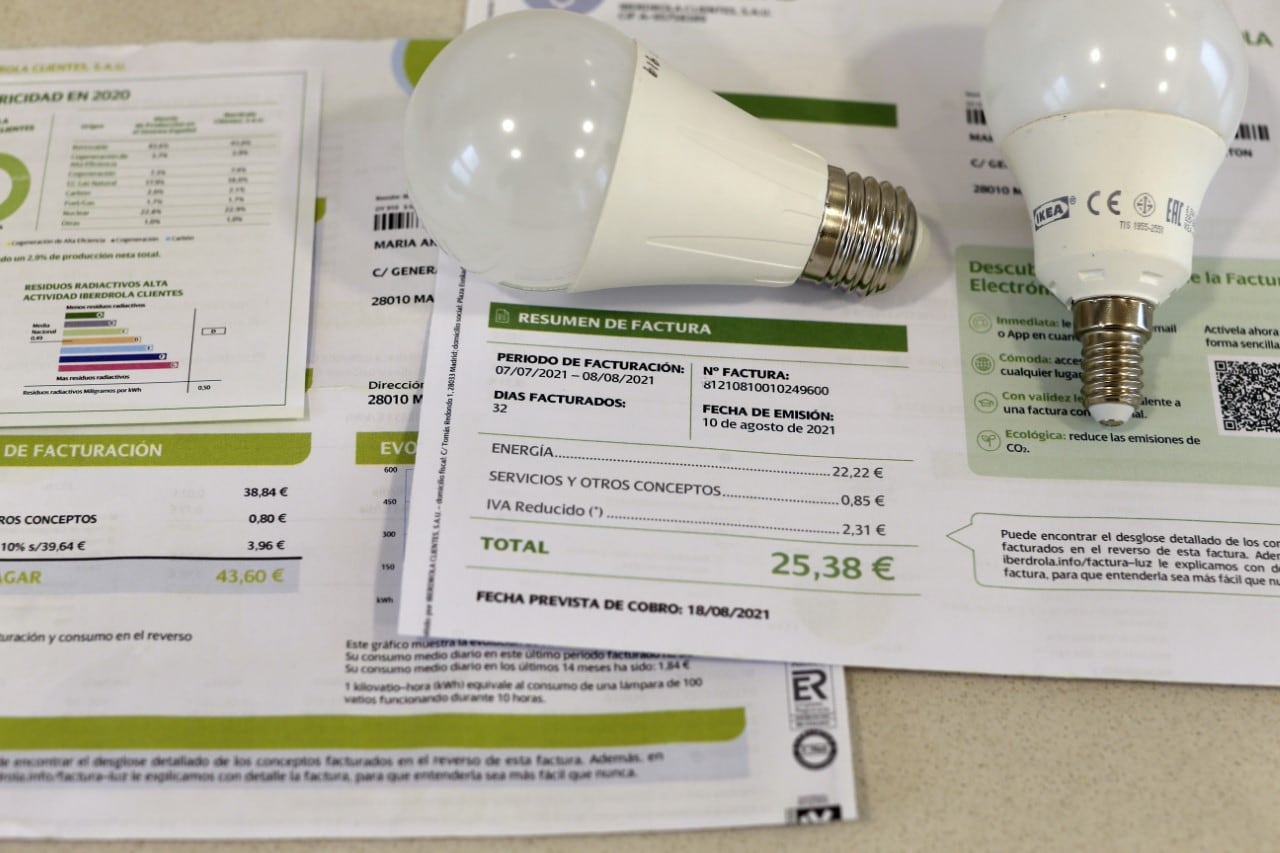

Is not required. Negative prices are reflected in the wholesale market. In the last invoice paid by the user, it is not accurately paid for the power produced by the power generation (nuclear, photovoltaic, wind….), But also other costs such as toll and charges, capacity payments. Therefore, there are no negative prices on the bill, although it can be a little less expensive.

On the other hand, there are many consumers who have fixed price contracts that do not reflect daily or hourly fluctuations of wholesale fuel markets.

Similarly, this tariff is also an adjustment mechanism because users with a voluntary price for the Small Consumer (PVPC) are not even benefited because of the low prices in the market, and the price of KWH is expensive, and it is expected that prices are negative and the price is reduced. The invoice is slightly fluctuating depending on the demand.

Negative prices of energy are new normality?

Since more renewable forces are connected to the network, power prices in the coming years are likely to fall higher than zero, unless battery storage is not increased, to absorb the surplus of energy production.

The Couprication Batteries, along with air and solar assets, are becoming more and more popular, as renewable energy promoters are trying to store their additional production and take advantage of the intermediary opportunities obtained from the instability of electric prices.

Most network capacity helps prevent negative fuel prices, as additional supply in an area is transferred to countries and areas with high demand.

Identifying batteries close to this demand centers can also reduce network congestion problems and expensive improvements.