After the merger, two 60 -Story towers should be in the Robounas in a total of 30 houses

Focusing on compact apartments in Sao Paulo early with a profile, Incorporator An inventionIt is GICFrom Singapore’s Sovereign Fund, as a partner, making its biggest bets in the luxury market.

It is one of the most valuable areas in the city of Sao Paulo, with a Giga Venture, each of the two 60 -storey towers shining eyes in the Rebounas area.

Datajap’s special study, conducted at the request The test, It shows that the area in the vicinity of Pinheros is expensive. In 2019, R from $ 10,900, the sale of the square meter reached the R $ 18,200 in 2024.

During this period, the average price variation for sale in the state capital was 26%, while the Rebounas hit 66%.

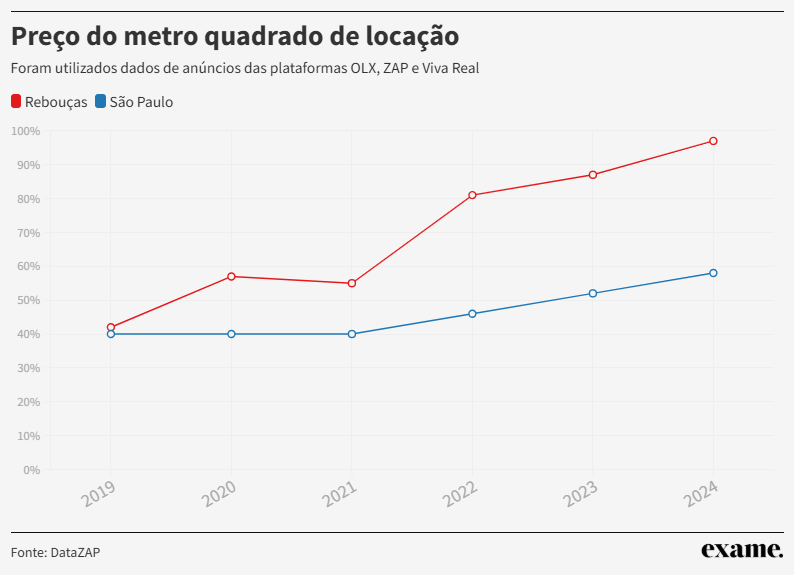

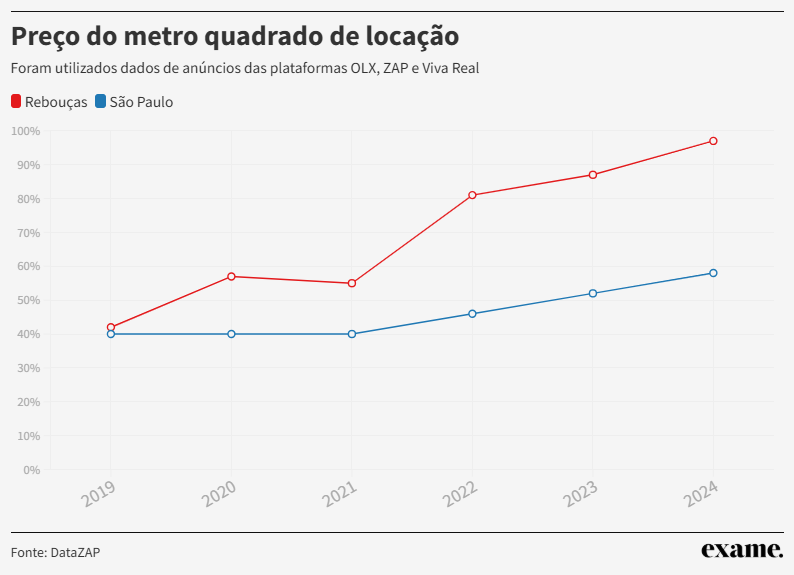

When the lease is reached, the value of the price of the square meter in this area is 132%, while the diversity of the total state capital is 45%.

A. An invention It was founded by Milton Goldfarb and former Goldfarb in 2013. In the following year, the developer was asked by the Singapore Sovereign Fund (GIC), which he joined the company. Since then, nearly 10 ventures have been launched per year in the compact market – The wave surfed with the faith of good returns.

During the pandemic, an invention began to look at the appropriate of people looking for large apartments.

The review of the Sao Paulo Master Plan has also begun to allow higher buildings. The developer played in the luxury market as a result of the equation – And soon, its start Big VGV From history.

The project at a defined name Rebounas has the value of normal sales R $ 2 billion. The experiment was scheduled for the first half of 2026.

The land selected for this venture occupies 8 thousand square meters and it is necessary to seize 26 houses in three years of negotiations.

“It’s an ant job. We have partner brokers. They knocked out of the door to the house, and the owners were interested in selling their homes,” Petrin said.

The territory occupies 8 thousand square meters in the heart of Rebounas (an Innovation/SEU Product 360)

The vice president of an innovation, on average, is 25% higher than the total evaluation of houses leading to mega land.

The company is still buying the last places and hopes to complete the acquisition process of all 30 assets. The new project occupies the Avenues such as Faria Lima and Brazilian Avenues, neglecting the gardens, in a strategic area, near the widely transmitted roads. Faria Lima E. Brazil.

The high standard development consists of 300 to 450 square meters of units, the average value of the square meter is around R $ 35 thousand, which consolidates a strong competitor in the city’s luxury market.

Plans for compacts and Future

The success of an invention in the compact apartment market is the basis for extending to the luxury market, with more affordable and high liquid units.

According to the company, 24% of small apartments buyers are not from Sao Paulo, which strengthens the request of the company for investors from other areas.

Over the last three years, the company is 11 in 2022, 9 in 2023 and by 6 and 6 and 6, the average value of the square meter is r $ 14,000 to R $ 20,000. Unlike medium standard consequences, the company claims that these compacts are very “liquid”, that is, easy to sell.