Corporate real estate funds are breathtaking with high occupation and praise of real estate

Por Anita Granner Scale, sDirector of Osia and Real Estate Investment Area

The corporate slabs market follows the positive trajectory, which gradually reflects the restoration of economic activity and the demand for quality corporate areas. Occupancy indicators and average rental value maintain high trend, but physical gaps are stable. The scene is suitable for corporate real estate funds, with opportunities for the distribution of assets and attractive income.

Performance and activity indicators

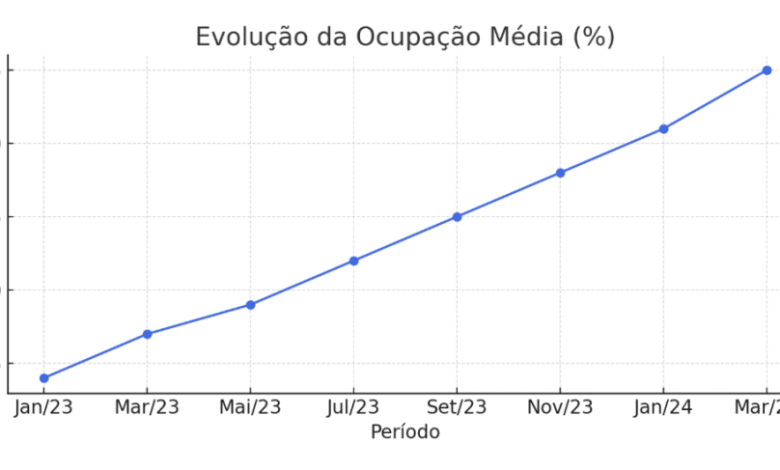

The average professional index of corporate companies has already reached 88.5% in March 2024, which has consolidated the eighth consecutive growth of January 2023. This movement shows the beginning of the progressive re -umption of the corporate environment, for the well -established features and driven by the largest search with modern infrastructure.

The average rental value also provided positive evolution, which reached R $ 94.60/m². This growth reflects the highest profession, the shortage of premium spaces in strategic places and the value of prices in accordance with the value of assets.

Market opportunities

Expectations for the corporate market are optimistic. The gradual reduction cycle of the basic interest rate contributes to increasing the charm of real estate funds, strengthening the capital flow to the field. The tendency to appreciate rent in consolidated areas should be followed, the instant offer of increased profession and higher standard places.

The integration of hybrid work models is well -located and suitable for effective buildings, which should be kept under control of physical space and supporting the equity of corporate assets.

The corporate slab market recovered a moment’s solid and steady. Real Estate Funds configure real estate funds for this section as an attractive alternative to investors who seek high occupation, rent elevation and empty rates, medium and long -term repetitive performance and potential praise.

Business movements and behavior

According to data from SIILA, from 7,888 companies supervised in the corporate sector, 1,660 (21%) moved from the first quarter of 2020, with an average growth of 24% in the occupied area. Companies with less than 500 m² achieved an average growth of 64%, while areas with more than 500 m² were reduced by an average of 7%. For large occupations (more than 5,000 m²), average reduction is 14%.

When we saw the end of the year 2024, 227 movements were recorded in high standard corporate buildings (Class A, AA and AAA):

– 5% of companies have reduced the area, average -23%;

– 30% new owners, an average of 1,000 m² for each profession;

– 27% expanded the aggression in the same building, average 1,700 m²;

– 38% changed and expanded occupation, average increase of 110%, from 850 m² to 1,800 m².

Below are some instances deserving to highlight:

– Extending from 5,400 m² to 7,400 m² at Clabin, Faria Lima;

– Verizer, from 2,900 m² to 7,000 m² in City Park;

.

Analysis of current data reveals the corporate market in the Frank recovery, with positive indicators of profession and rentals. Business movements demonstrate confidence in the attraction of economic environment and quality corporate places. With the continuation of this trend, the sector will continue its upward trajectory, provide good opportunities to investors and strengthens the performance of corporate real estate funds.