6,000 loans for CLT records and more than 29 million simulations

The Ministry of Labor and Employment reported on Saturday, 22 29.301.348 Simulations Of Payroll loans for workers with signed portfolio (CLT)2,962,330 requested proposals and 6,683 credit contracts.

DataPreve has approved data, which has been considering the last 3 months that the volume of access to digital CTPs is 12 times higher than the weekly reference.

The new type of credit came into force on Friday, created by MP No. 1,292. The idea is to facilitate credit for 47 million workers with an official agreement, including domestic, rural and MEI employees.

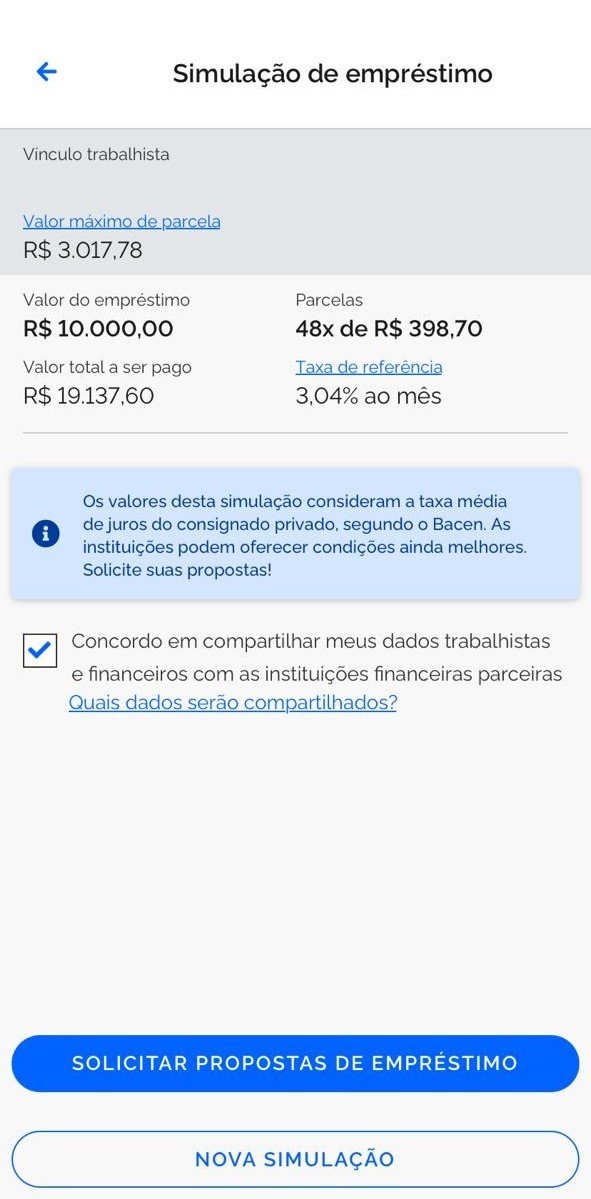

The new credit guarantee has been guaranteed to give interest workers credit to less interest workers. Reference Rate Rate of Application in Simulation 3.05%per month.

According to the government, to hire a new payroll, the worker must access the application Request the Digital Work Card (CTPS Digital) and proposal. Within 24 hours, you will receive proposals and access the selected bank channel to finalize the contract of credit. The system is already running through the application.

Oh Payroll Loan This is a method of directly discounted on the payroll or purposes, which makes the operation safe for banks.

Prior to this government measure, access to payroll loans for CLT workers was further limited, as it was based on contracts between companies and banks. For those who have made the InsS public and retired, the sport has already been widely used.

See how to imitate the proposal from the new payroll loan to CLT

- Access the app From Digital Work Card (CTPS Digital) – Need to use the login and password of Gov.BR

- On the home screen of the Digital Work Card app, you need to click on the “Loan” icon “

- Click on the “Simulate” option

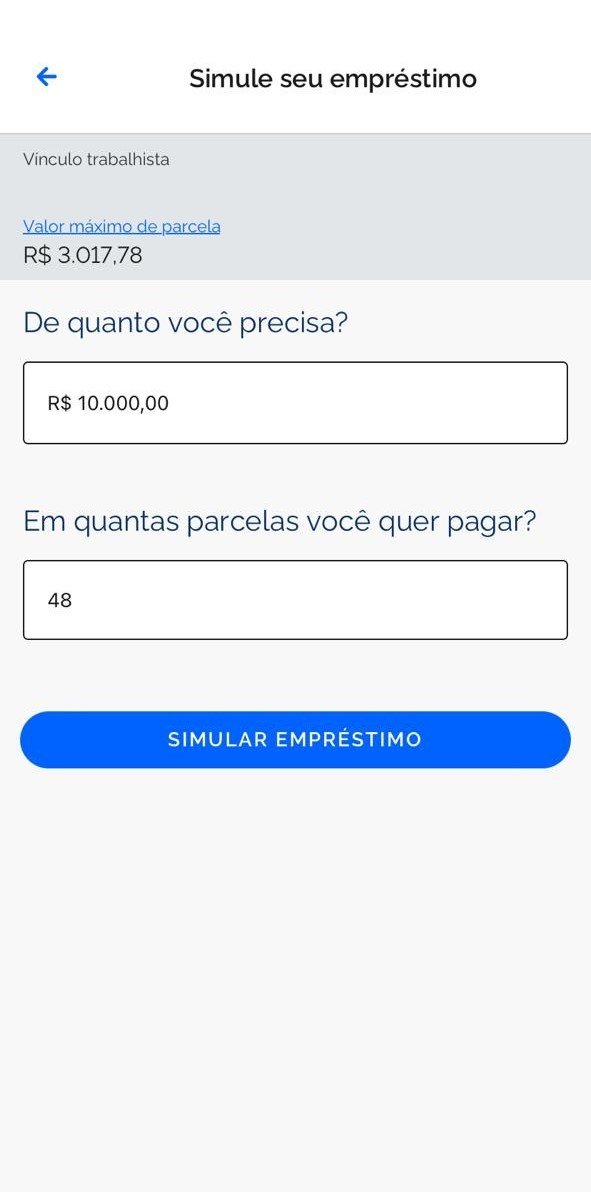

- In the next screen, it is necessary to include the value and size of the required installments. The system records maximum installments value

- Next, the system informs the reference rate and the values of installments

- The worker must agree to share data with banks in the bank before making a request for a loan proposal

- In the end, the system states that the worker will receive proposals from the banks within 24 hours

See some questions and answers provided by the government to clarify the new rules of private consignment:

How to appoint CLT LOAN?

In this first step, the worker’s app must be accessed Digital Work Card (CTPS Digital) to request credit proposal. The Ministry of Labor Access, such as CPF, the margin of the salary available for commodity and business time, is required to qualify for financial institutions who qualify for data.

Considering the value of credit 35% salary consignment margin And to include FGTS as warranty.

From the authority to use the data, the worker receives offers up to 24 hours, analyzes the best option and hires on the bank electronic channel.

Debt installments are subsidized on the payment sheet of the monthly track by associal.

After the appointment, the worker follows payment updates per month. Since April 25, the worker can also hire electronic channels of banks.

How to imitate the payroll loan to CLT?

According to the government, those interested in recruiting credit makes the request of the proposal by applying Digital Work Card (Digital CTPS). The answer with conditions and possible simulations, is sent to the worker up to 24 hours.

Who is eligible for the new payroll loan?

Worker with an official agreement, including rural and domestic Salaries of My friends.

How is the installment reduction going?

Debt installments are discounted on a monthly worker sheet. After the appointment, the worker follows payment updates per month. Since April 25, the worker can also hire electronic channels of banks.

If I have a payroll already, can I migrate?

Workers with leaf discount loans already can change the existing agreement from April 25 this year to a new model.

What can be given as a loan payment guarantee?

Up to 10% of FGTs for worker guarantees and 100% closing fine in case of resignation can be used.

Is this process only by digital wallet or can I go to the banks?

Initially, CTPS is only in digital. Since April 25, worker can also start hiring bank channels. Through the CTPS digital, the worker is likely to receive proposals from all interested banks, which allows comparison and the most beneficial option.

Do activities only be through qualified banks?

Yes. The beginning of qualification depends on the publication of the temporary measure.

Do all banks have access to workers’ data?

Only the data required for companies to make credit proposals: the salary margin is available for name, CPF, consignment and business time.

Will the migration of Direct Consumer Credit (CDC) be automated to Worker Credit (CDC)?

The worker with the CDC should look for Qualified Financial Institution, if he wants to migrate to the worker credit.

After the credit of the worker, is it possible to port the bank with good fees?

Yes. Portability is available from June 2025.

Will the Worker Credit replace the anacenal withdrawal?

No, anxious withdrawal will be in place.