US home approves the money sending line if he draws reviews from Mexico

The US House of Representatives passed the law on Thursday, which will deceive some Mexican officials to pay a 3.5% money tax on funds sent abroad by non -US citizens.

The Ambassador of Mexico to the United States of America Estephen Mocdezuma celebrated tax cut From 5%initial plan, Mexican President Claudia Shinbam has said that any line is unacceptable, arguing that such a move would violate contracts that prohibit double taxation.

Message on the position of sending money

The Rules Committee approved the reconciliation collection, which includes reduction of the money sending tax from 5% to 3.5%, although more cuts for medical aid and tax benefits …

– Estepan Mogtezuma Paragon (@emotezumab) May 22, 2025

On Friday, Shinbam called for the formation of a permanent financial group to address the problems of financial integrity and economic sovereignty.

This project – part of a wide fund set by US President Donald Trump – now goes to the US Senate, where Republican leaders hope to win the end of July 4.

Sending money is the fund that migrants send to friends and families in their own countries. Mexico paid $ 64.7 billion last yearThe 11th year is a 2.3% increase and continued growth than 2023.

Sending money to Mexico is the largest single source of foreign income-the world’s second largest payer-payer-and 4.5% of the total GDP of last yearAccording to Strategic and International Studies Center (CSIS).

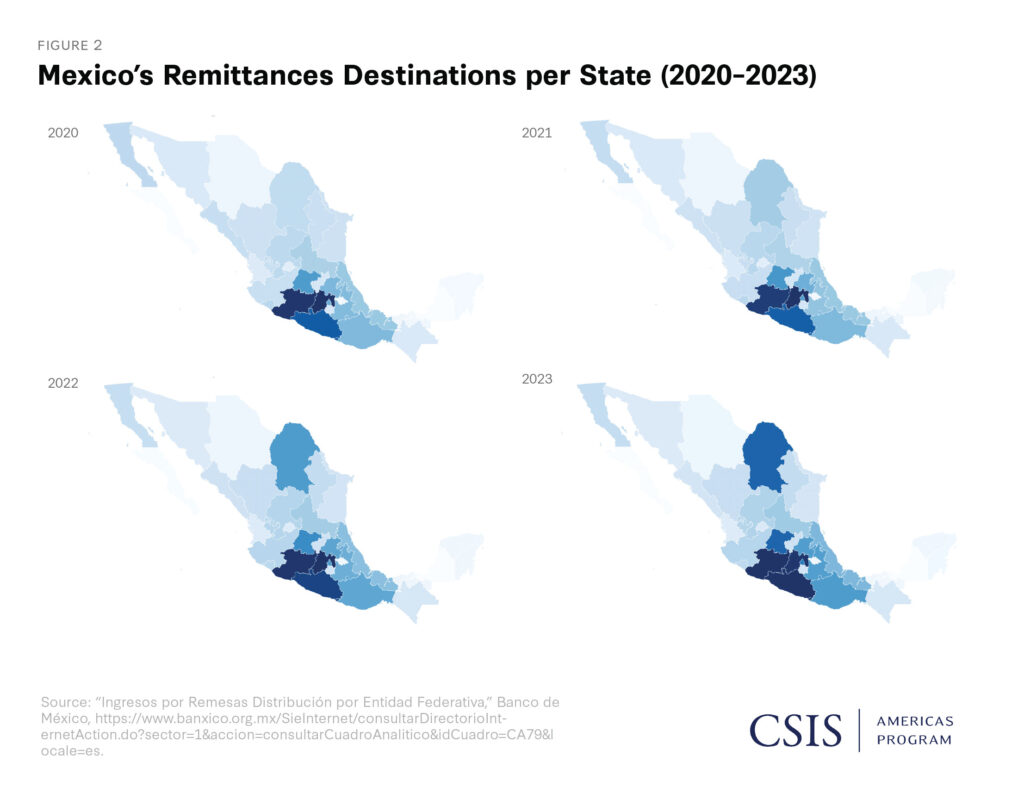

Mexican financial executives (IMEF) said that “a tax will negatively affect state -level domestic production in regions that rely heavily on sending money.”

According to CSIS, sending money “offers a subsidiary income to Mexican families (and) the constant flow of the development fund for the country’s poor subordinate areas.”

As of 2022, the average money transaction sent to Mexico was about US $ 390. CSIS considers the average monthly salary of Mexico as approximately 6,150 pesos (US $ 297), such transactions Can contribute a significant part – or full – in the income of a family.

“This income is especially necessary for the Mexican people who are involved in informal labor, and they have no employment stability and safety nets to ensure constant income,” CSIS said.

The news about the proposed line was triggered Mexico’s Foreign Ministry to publish a report On May 16, he said, “I will follow strong political and legal security against the proposed money.”

Foreign Minister Juan Ramon de La Fun said, “There is no justification for the proposed tax on sending money. We do not accept it.” De La Fun said that the bill targets people who already paid tax and significantly contributing to the US economy.

“The sending of money refers to only 18% of the income earned by our comrades, and the rest depend on the United States,” he said.

Mexican legislators went to Washington DC, To lobby to remove the line. They argued that this action was based on double taxation, Since migrants already have to pay US income tax Regardless of their settlement.